Asset Turnover Ratio: A Measure of Operating Efficiency

Not only can we calculate turnover ratio for total assets, but we also can do the same for other asset items such as AR, inventory, etc.

Return on Investment is dependent on two things: effectiveness and efficiency. To measure effectiveness, we can use gross profit ratio and net profit ratio. To measure efficiency, we can use total assets turnover. Now we will talk a little bit more about the total assets turnover.

Turnover is a measure of business operations capacity

Generally speaking, we use turnover as a measure of business operation capacity. We've already talked about total asset turnover, but there are different types of assets. As a matter of fact, we can actually calculate turnover for every asset.

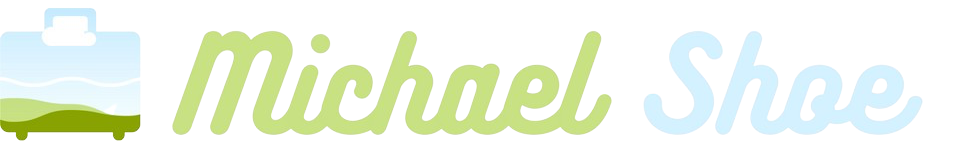

Just like how we calculate total assets turnover, which is revenue divided by total assets, we can calculate different asset turnovers by having revenue divided by an asset. This is the turnover ratio for a specific asset.

For example, by using revenue divided by account receivables, we can get accounts receivable turnover, which is a measure of accounts receivable efficiency. Similarly, if we divide revenue with current asset, we can get current asset turnover, which is a measure of current asset efficiency. And revenue divided by fixed assets is called fixed assets turnover.

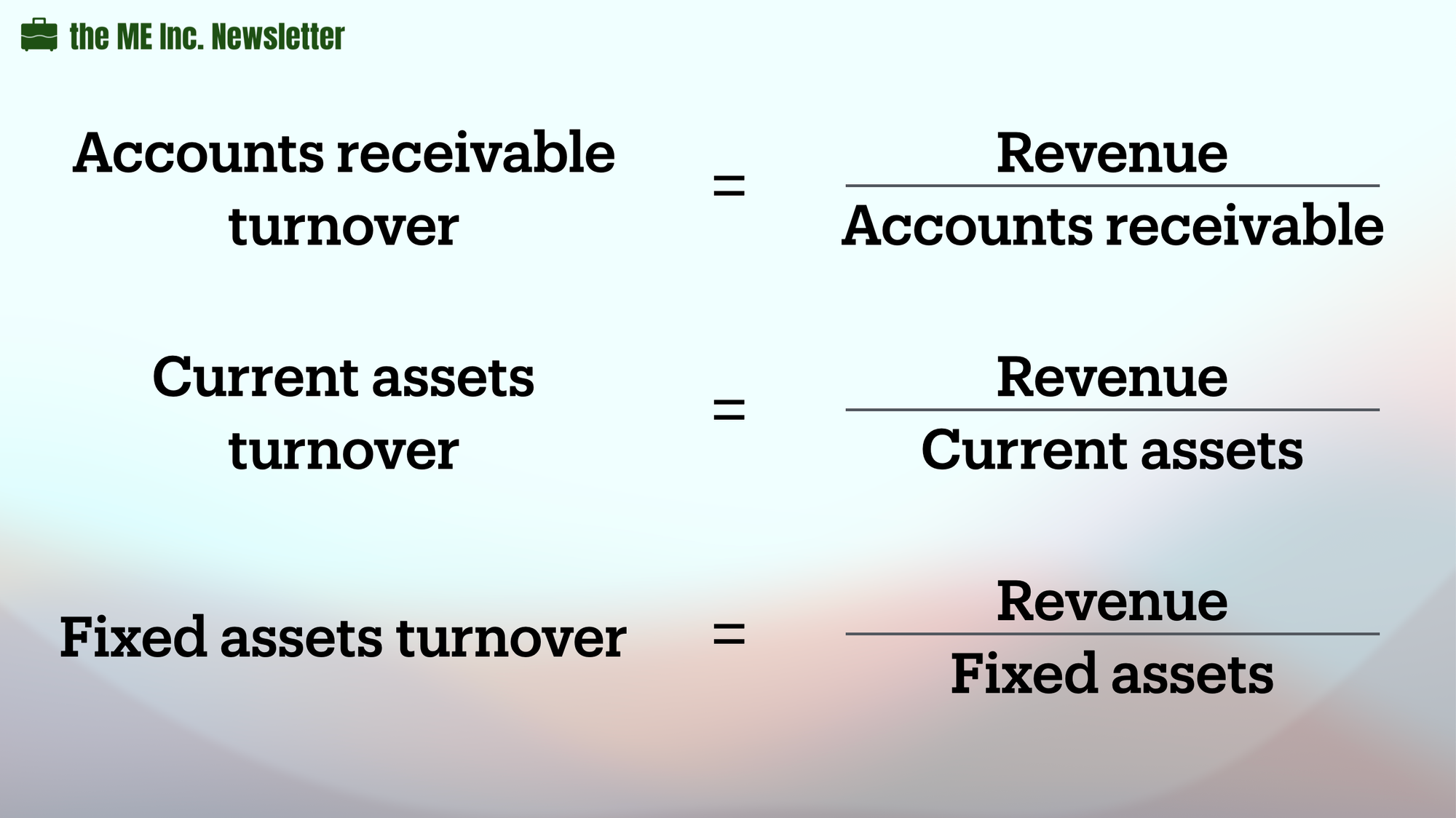

The only exception is inventory. Even though in theory, revenue divided by inventory is not wrong, but in practice, we generally use another way to calculate inventory turnover, which is using cost of goods sold divided by inventory.

Why is that the case? We have covered that there is a close relationship between inventory and cost of goods sold. After producing a certain product, it becomes inventory. Inventory will NOT become cost of goods sold UNLESS the product is sold. As a result, it makes more sense to calculate inventory turnover by using cost of goods sold instead of revenue.

Duration vs. Point of Time

While calculating turnover ratios, we are always using numbers from the income statement, i.e. revenue or cost of goods sold, as the numerator. However, the denominators are always from the balance sheet. We have mentioned that balance sheet is based on specific time point, but income statement is based on duration. If we use division on these two data, which have different time frames, we might encounter some problems.

Actually, the assumption when we are doing such calculations is that the asset is the annual average. We don't know for sure if this assumption is accurate; a common method to offset inaccuracy is to use the average of the beginning value and the final value of a specific asset during the period. Same thing goes with inventory and cost of goods sold.

However, doing so would cause another problem. We have previously said that by multiplying effectiveness and efficiency, we will get return on investment. This relationship exists at any points in time. However, when we switch to using average values, this equation may not work.

After judging the pros and cons of both issues, i.e. the duration vs. point of time issue and the above equation issue, we would normally revert to using a simplified method of using the en-of-the-year value of assets while calculating all financial ratios.

Economic implication of turnovers

Turnovers measure the number of times an asset has circulated in a year. For example, how many times will the asset circulate in a given time period?

As a result, apparently the turnover unit is the number of times the asset has been circulated in a year.

If an asset is circled twice a year, we would normally say that the turnover of this asset is 2, and it takes half a year for the asset to make a circulation. So turnover ratio helps us calculate the length of an asset's circulation.

Let's calculate the assets turnover using the financial statements of our fictional company.

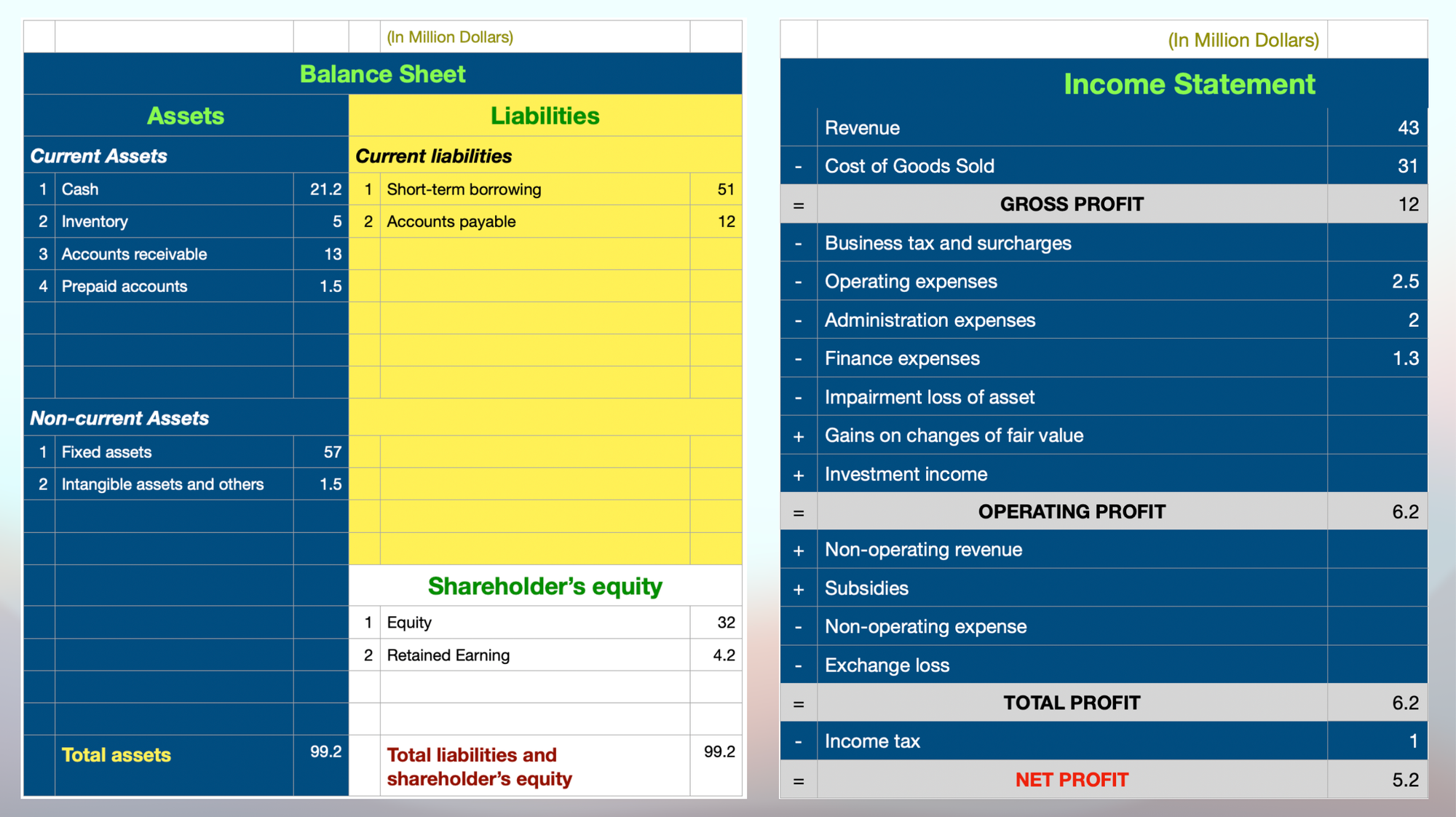

Accounts receivable turnover

First, let's look at the accounts receivable turnover. The way to calculate accounts receivable turnover ratio is to take revenue and divide it by accounts receivable. In this case, our revenue is 43 million dollars and our accounts receivable is 13 million dollars, and accounts receivable turnover ratio is 3.3. In other words, the turnover is 3.3 time a year, which is about less than four months in one circulation. To be more specific, if there are 365 days in a year and turnover is 3.3 times, it means one circulation will take 109 days, i.e. our accounts receivable can be collected every 109 days on average.

Inventory turnover

What about inventory turnover? We've already covered that inventory turnover is cost of goods sold divided by inventory. For our fictional company, the cost of goods sold is 31 million dollars a year, and the inventory is 5 million. By dividing 31 million with 5 million, we will get 6.2, which means the company's inventory circles 6.2 times a year. In other words, it takes about 2 month for a specific batch of inventory to finish one circulation. The calculation works like this: by dividing 365 days/year with 6.2, we will get 58 days as the result. This means that on average, the company will need to hold inventory for about 58 days.

For the above example, when does the inventory holding period start and when does it end? How do we actually make sense of the 58 days?

We know inventories include raw material, product-in-process, and finished goods. Inventory holding period is defined as starting from the purchasing of raw materials to the selling of finished goods, which is a cycle (or circulation). For our fictional company, this cycle takes about 58 days.

When a company makes a sale, part of its inventory (on the balance sheet) will move into cost of goods sold (on the income statement). After making the sale, part of the revenue will be collected as cash, but part of it will become accounts receivable, which later will be collected and become cash. For our fictional company, the inventory holding period is 58 days and the accounts receivable collection period is 109 days, which add up to 167 days in total. What this means is that it will take a little less than half a year to turn cash into materials and back to cash again for the company.

Fixed assets turnover

We can also easily calculate the other assets turnover ratios with this method. For example, the fixed asset turnover is calculated by dividing revenue with fixed assets. For our company, the revenue is 43 million and fixed asset is 57 million, making the fixed assets turnover 0.8. In other words, the circulation of fixed assets will NOT complete in a year. A less than 1 fixed assets turnover is pretty normal, especially for a large manufacturing company.

Current assets turnover

Similarly, we can calculate the current assets turnover as well. By dividing revenue (43 million) with current assets (40.7 million), we can get our current assets turnover ratio of 1.05, which means that our current assets can finish circulation within a year.

Total assets turnover

Last but not least, we can calculate the total assets turnover. The company's total assets turnover is revenue divided by total assets; the revenue of the company is 43 million and the total assets is 99.2 million, making the total assets turnover 0.43.

Return on investment - for who?

Combining all the above turnover ratios, including that of total asset and all other assets, can help paint us a picture of the operation capacity of the company. We said turnover ratio indicates efficiency, which when combined with effectiveness, will determine the return on investment.

Return on investment is one thing that we, as consumers, also encounter every day. For companies, it shows the rate of return on total assets. In other words, it's the return I can receive after I invest in the total assets. However, if you pay special attention to where all assets are coming from, part of them actually come from resources provided by creditors such as banks. In other words, the resources of total assets are from two parts, one part from creditors, while the other part from stockholders.

Return on net assets vs. return on total assets

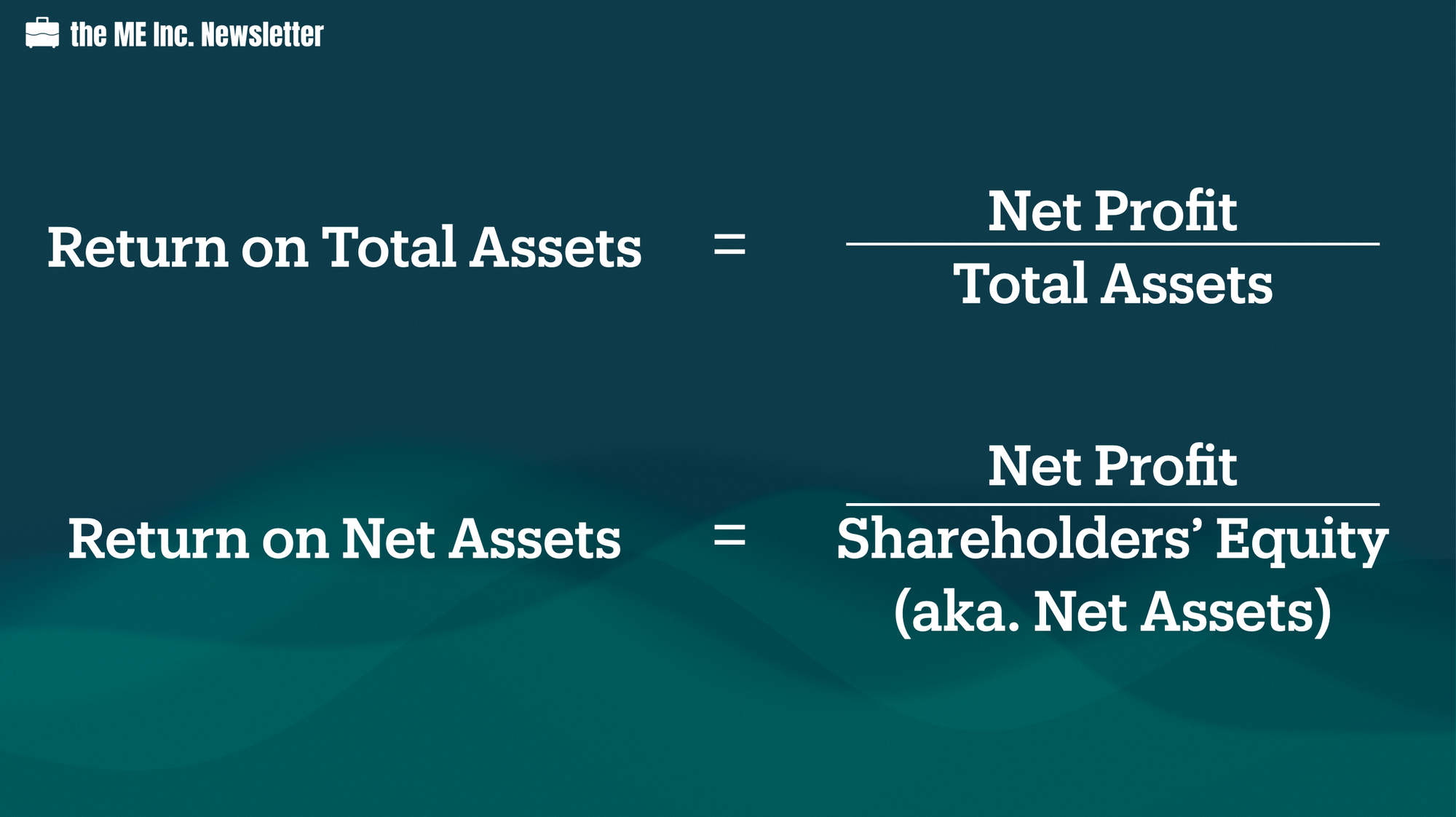

For stockholders, they actually care more about the return on their own investment. Here we come up with another concept: rate of return on net assets, which is calculated as net profit divided by stockholders equity.

The amount stockholders invest in the company is the stockholders' equity. The return for stockholders' investment is the company's net profit. If we take the net profit and divide it by stockholders' equity, we will get return on investment for the shareholders' investment in the company.

However, shouldn't we just call it return on equity instead of return on net assets?

Well, technically we could, but the conventional practice is to use the latter. The reason is that we can often refer to stockholders' equity as net assets, since stockholders' equity equals total assets minus liabilities. That is to say, the net value of the company actually belongs to the stockholders.

Now let's calculate the return on investment for total assets and net assets and see what we get.

First of all, let's look at the return on total assets. Return on total assets is calculated as net profit divided by total assets. The company has a net profit of 5.2 million this year and its total assets are 99.2 million. After dividing the former by the latter, we get the return on total assets at around 5%.

Next, let's work on its return on net assets. The net profit of the company is 5.2 million and the stockholders' equity is 36.2 million. After doing the same calculation, we arrive at the company's return on net assets at about 14%.