Analyze Balance Sheet to Understand How Companies Work

Understanding how companies work by reading balance sheet. Compare manufacturing, service, pro sports, and agricultural companies.

Why do we need to read a Balance Sheet? It's not fun.

The goal is to understand how a company actually works.

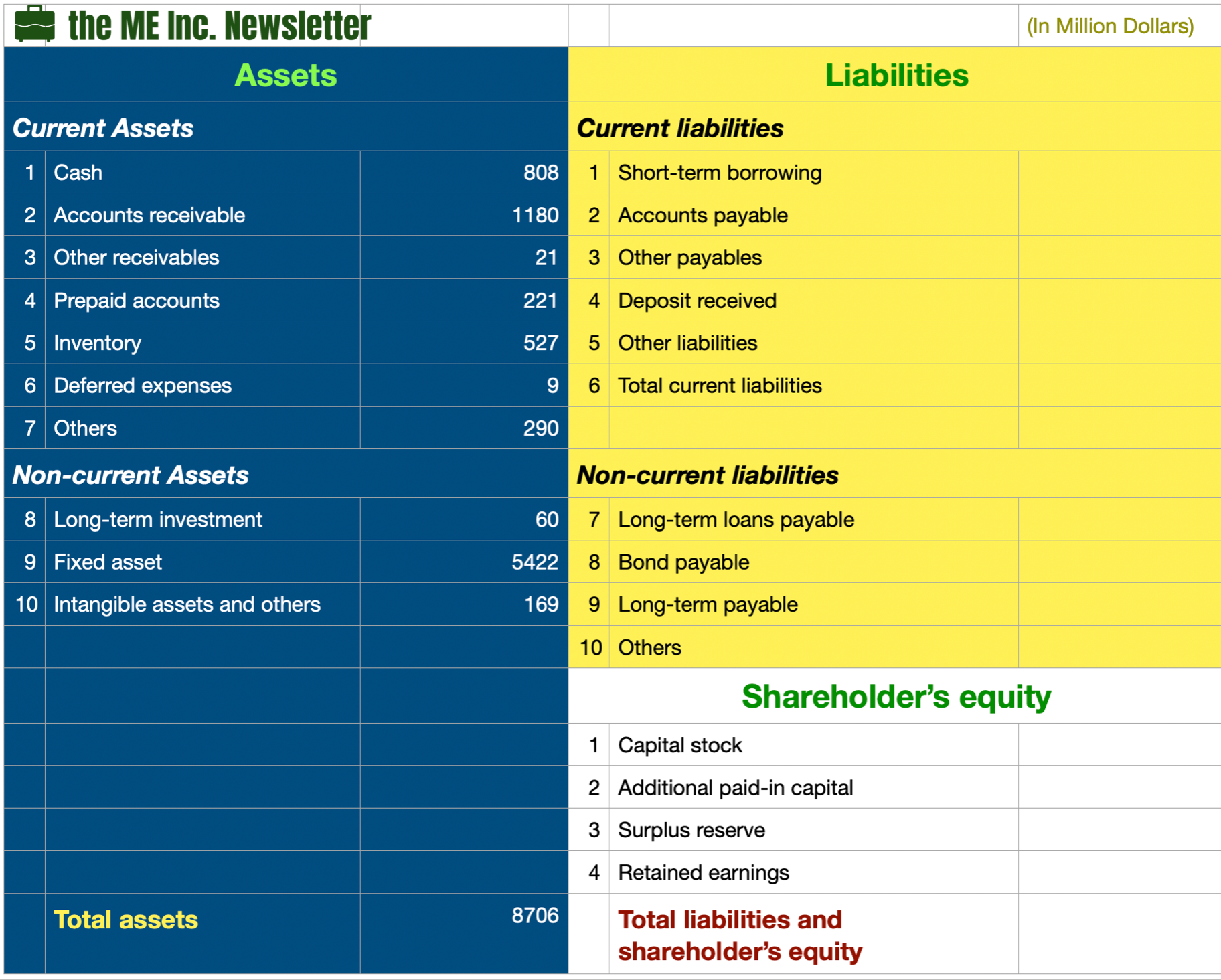

Although we understand the asset items now, they are isolated from one another. How can I "see" a real company when all the pieces of asset items are put together?

This is truly about how to "read between the lines". Let’s look at the same Balance Sheet again.

Manufacturing Companies

Can you identify the biggest asset of this company?

If you check carefully, you may discover that fixed asset is the largest item of asset. For this company, the total asset is around 5.4 billion USD.

What about the second largest asset item?

Accounts Receivable - it's worth about 1.2 billion USD.

If a company’s largest asset is fixed asset, and the second largest one is accounts receivable, what business do you think the company is in?

This is pretty easy to guess. And yes, you might have guessed it - it is a manufacturing company. What's more, it is a capital-intensive manufacturer requiring upfront asset investment.

What about competition?

Considering that its second largest asset is accounts receivable, and accounts receivables allow our customers to pay later, making our goods more competitive in the market, it's safe to say that this company is facing serious competitions in the market.

As a matter of fact, high fixed assets, high accounts receivables are two traits commonly found in most competitive manufacturing companies.

Service Companies

In our daily lives, we might face more companies in the service industry, and for most of us interested in entrepreneurship, manufacturing is not something we look forward to starting a company in. So what does the balance sheet of a service company look at?

Let's use a design company as an example.

A design company is essentially just a bunch of people working on their computers in an office. You may guess intangible assets are what the design company has, such as brands, technology or even goodwill. But what if this is a newly formed company, with neither brand power nor goodwill, and it solely relies on brains and has no patent?

For this infant company, the most valuable asset of is people - the employees. This is easy to understand. But how can "people" be reflected on the balance sheet?

Maybe under intangible asset?

Or fixed asset?

The answer is actually neither. Even for companies whose most valuable resources are people, such as a design company, they won’t put people under the asset.

Employees are hired, not owned by the company. They are not assets that can be sold or disposed.

Pro Sports Clubs and Pro Athletes

But is there any scenario where people actually become assets?

Well, there actually is.

Professional athletes in Europe or North America get paid huge salaries for performing at the highest level on earth. We often hear that pro players get multi-million contract extensions. Within the contract period, the athletes play for their own franchises, but the franchises can also trade players with other counterparts. In this case, professional athletes are more like assets, which can be bought or traded among multiple parties (clubs). For example, if a club signs a $150 million, 5-year contract with a star player, that money should be put in the deferred expense item, since the player contract is creating some future benefit to the club.

Agricultural Companies

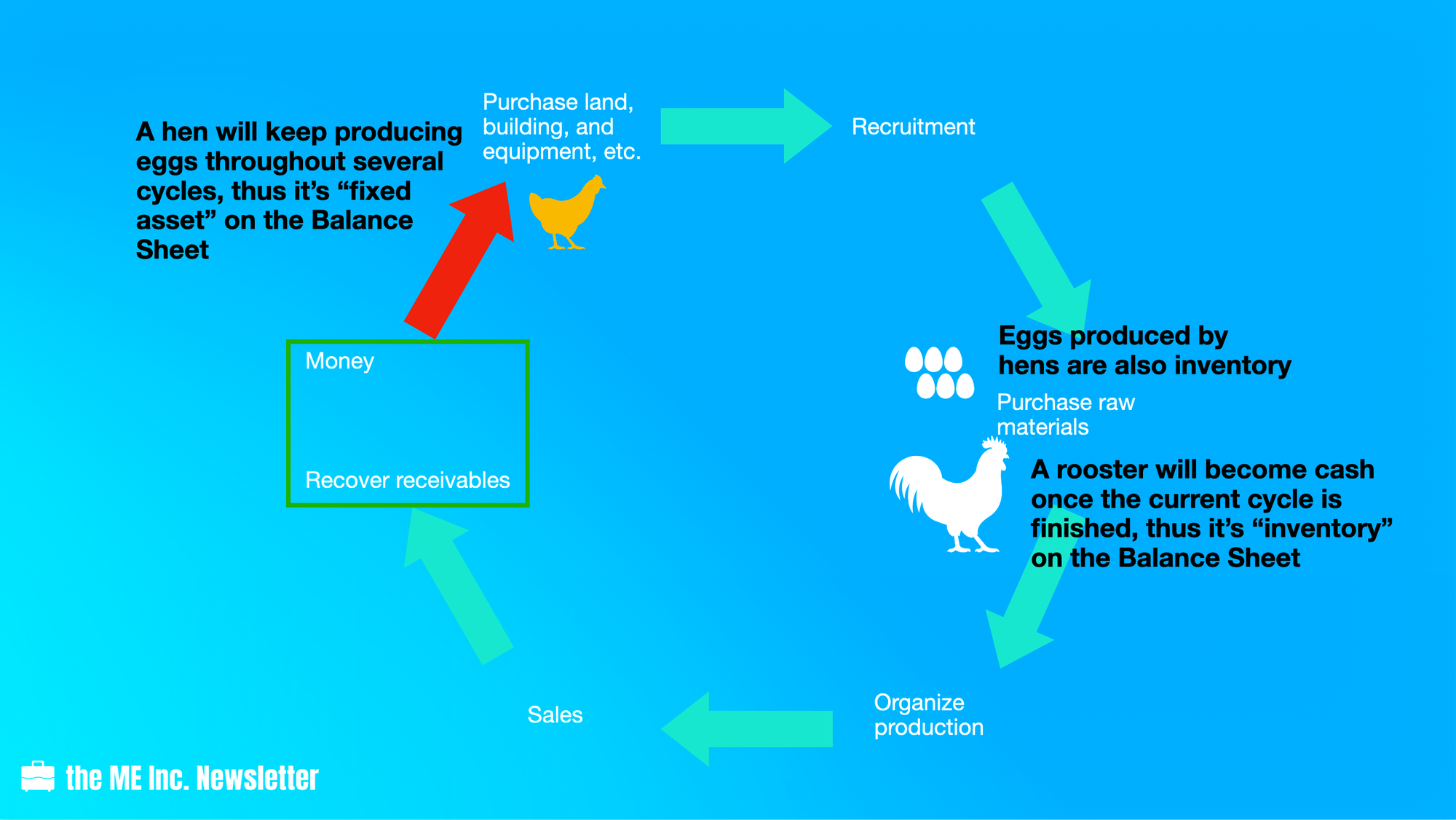

Now we have looked at people, what about animals? There are many companies in the agriculture industry.

For these companies, animals such as chicken or pigs are referred to as biological assets. Animals and plants all belong to this category.

Let's say I have a farm cultivating chicken. Where should I put my chicken on my balance sheet? Well one thing for sure is that there won’t be an item called chicken.

I'm tempted to treat my chicken as goods; so I should treat them as inventory. However, that might only work in half the situation.

Since my farm cultivates both roosters and hens, I will need to treat them differently. Well roosters are cultivated mainly for the meat, hens are actually for the eggs. From this perspective, roosters should be treated as inventory, because they can turn into cash in a single cycle, while hens should be treated as fixed asset since they last longer than a single cycle and can generate future value.

As we learn deeper and deeper in this topic, you may find out that except for financial sector, almost all industries use the same format of financial statements. However, behind the same format are vastly different companies operating in different industries with different business structures. The same asset item may have completely different meaning in different industries too. When all these assets are organized, they paint a picture of a real, lively company.